Save time and money with my best-selling resources in Complete Change Your Finances Bundle.

December Savings Report and 2015 Savings Totals

Do you really know how much you are saving?

I had no idea how much I was actually putting into savings since my finances have felt like a revolving door. Put money in savings, pay for school, put money into savings and pay for school.

Early in 2015, I started tracking how much money I was able to save each month. I had reached a huge point of discouragement and despaired of ever making true financial progress and needed to see some traction.

This post contains affiliate links.

There were months where I was only able to put aside $33 and you encouraged me to keep at it. Reminding me that all the small amounts add up over time.

Several months had very high numbers and I had to keep rechecking them, since they didn’t seem right. Was it really possible I was able to save that much??

So what counted as being put into savings? Anything which was set aside for annual bills (not due that month) and any additional money above the minimum I needed for regular household expenses. I didn’t count money set aside for taxes, with one exception, as that money came directly out of my business account.

When I started tracking my savings, I had three goals to work on. Continue paying cash for my husband’s education. Build a 3 month emergency fund. Start a car replacement fund. I realized mid-way through, that I was really only making progress in one area, saving up for tuition.

December 2015 Savings Report

Extra money | |

Skimmed money from budget | $37.37 |

Trimmed monthly expenses | $91.00 |

Money saved for annual bills Freelance work | $501.00 $851.90* |

Second Job | $419.51 |

*(390.90) | |

Total Saved | $1,906.74 |

*Some of the freelance money had to be applied to household expenses.

Where the money is going:

Account | Amount | Running Total |

|---|---|---|

Emergency | $118.11 | $1,546.94 |

Car Repair | 0 | $491.26 |

School | $250.00 | 3,855.00 |

Bills/Expenses | $1,538.63 | N/A |

Notes about December

- I need to follow up on unpaid freelance money before December 30th, if I want to receive payment in December. As a freelancer, I keep careful records as to when I need to invoice each job, when payment is expected, and how much will be paid. Then, usually, when the payment hasn’t been received when expected, I follow up immediately. Now, January numbers will be much higher.

- I didn’t work very many hours at my second job again in December. While the hourly rate is better than zero, if there is no other work, I have been so busy with more lucrative jobs that I am wondering if it is even worth it to keep working this second job.

- My hubby purchased some parts to fix my car (talk about saving money right there!), so our car repair fund was decreased.

- Speaking of my hubby, he again got a grant to help with his tuition for the spring, so there will be less money needed for that large expense!

- Several of our monthly expenses have crept up again. I will have to start seeing where I can start trimming money in January. It’s an ongoing struggle to keep expenses low, as costs continue to rise.

(This post contains affiliate links)

Now on to the fun part, how much money was I able to save in 2015?

Annual Totals

Extra money | |

Craigslist/Ebay/Amazon Sales Skimmed money from budget Trimmed expenses Annual Bills | $113.10 $320.57 $822.80 $4,645.83 |

Found money Cash back from bank Random money Second job Extra hustle/freelance money Blog income | $29.01 $35.01 $1,011.55 $5,085.67 $7,149.90 $35.16 |

| |

Total Saved | $19,248.60 |

Account | Final Total |

|---|---|

Emergency | $1,546.94 |

Car Repair | $491.21 |

School | $3,855.00 |

Notes

- The final amounts for the three main savings goals are what I have in hand right now after what has been spent throughout the year.

- Another year of school has been paid for and is out of the way.

- My accounts for all my annual bills have been built up healthily. There will be enough money in all the accounts to pay for each bill as it comes due for the first time in a while, which is a huge load off of my mind.

- Building up my emergency fund and saving for a new car will take a back seat until I can get the last part of my husband’s school paid. There are still small amounts each month which will go towards these funds, but the majority of extra money will go towards school.

You can see all the rest of my savings reports here.

I learned some very important lessons throughout this year.

1. Tracking your money goals is a game changer

I used several methods of tracking my saving. First, I used Quicken to enter in all my income and expenses. I do like the report aspect and comparing previous time periods. It is easy to look at everything all at once and to see how much money is in each account, especially all my sub accounts, but it was hard to keep up this year.

A pencil and a notebook were super helpful in keeping my spending on a leash. Every month, I write out all my expenses. With each pay period it was easy to write out what was getting paid with that money and to keep track of what was still needing to be paid. It was here that I also tracked how much I was able to skim off the budget categories, extra income sources, and amounts trimmed off of ongoing expenses.

The notebook was easy to carry with me and to work on it when I had a break at work. From the notebook, I then transferred everything to an Excel spreadsheet where there was certain categories and an ongoing tally of the money saved.

The data from the Excel sheet was then transferred into my blog posts each month where I detailed out for all of you where my extra income came from and how it was going to be applied.

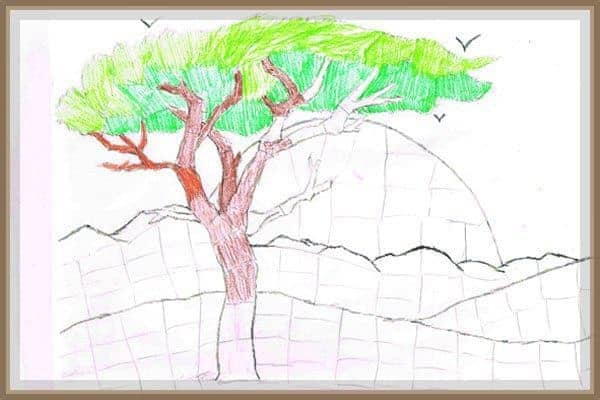

Finally, I started coloring in a picture to mark every $200 saved towards school tuition. I named it my Money Tree. This is a great reminder that I see multiple times a day, showing me just how much has been saved for tuition and how much more there is to go.

Between all of these methods of tracking my savings, I found myself being super motivated to cut costs and bring in more income to keep increasing my savings. I really liked the visual aspect of the notebook, the Excel sheet and the Money Tree picture. It was exciting to see the numbers grow.

Money Tree December 2015

2. Savings really add up

I had no idea that I would be able to save $822 over about 10 months by simply consolidating our cell phone plan, combining the cell phone bill with the internet bill, and negotiating a lower rate on my car insurance.

Seriously. That is all I did. I kept meaning to see if I could negotiate other bills, but was busy working and never got around to it.

Not to mention selling a few items online and bringing in more than $100! Plus not spending every last penny in my budgeted accounts each month and being diligent about immediately transferring the money into savings; added up to $320 of extra savings.

The small things really do matter. Regardless of where you are financially, if you put aside every little bit that you can towards your goal over a period of time, you will be surprised at how much progress you have made.

5 Lessons Learned From Tracking Every Dollar Saved Over 1 Year.

3. Focus is vital

I have learned that to be successful at reaching your money goals, you have to have focus. It is extremely hard to make progress on anything when you are trying to do several things at once.

Trust me, in 2015, I had the lofty goals of building up a three month emergency fund, saving enough money to replace my car, and paying cash for school. It just doesn’t work when you are trying to do so many things at once.

I did managed to pay for another year of school without depleting all my annual accounts, but only saved enough in the car replacement fund to cover all the necessary repairs, and just slightly increased my emergency fund by a couple hundred dollars.

This is one reason I recommend using the Debt Snowball method to paying off your debts. Paying off one debt at a time allows you to get through your debts so much faster.

I will be focusing on saving the remaining money so that my husband can graduate without any school debt in 2016. However, this goal should be reached within the first half of the year and upon completion, I will then focus on building up my emergency fund.

4. Working extra has big benefits

If you are feeling stuck with your finances or you aren’t making much progress, find something to do on the side. Work extra hours. Bring in more clients. Anything you can do to bring in additional income will greatly help you break through the cycle of being frustrated and stuck.

I have worked hard over the last several years, but really noticed a huge jump in my income and how much I was able to save when I picked up a second job. After I started the job, I was also able to pick up some more freelance clients and a lot more work from them.

You can really make a huge turn-around in your progress towards your money goals if you are willing to put in extra hours of work. So the question remains, how tired are you of being frustrated with not making any financial traction? Are you willing to work more, even if it is a temporary thing, in order to more quickly reach your goals?

5. Accountability Helps

Knowing that I was going to write a report to share publicly on the internet each month, influenced how I spent money and how diligent I was about tracking the numbers.

Plus, with my savings report being a monthly feature, I didn’t want to disappoint my readers. I made it a priority to continue to cut expenses and track ever dollar I was able to put into savings.

Keeping myself accountable by posting the savings reports on the blog helped me to stay committed to doing this experiment.

If you are working toward a goal and are struggling with the follow through, then find yourself an accountability partner that you can discuss your progress with each month. Find someone who you can trust to share your finances with and who will not let you get by with any excuses.

Once you start tracking your money progress, you realize just how much you can save!

After a year of tracking my progress of saving money, I realized how much I can save, even when it doesn’t feel like I am saving money or making much traction with my finances. The motivation from doing this experiment was incredible and I found myself able to accomplish more than I was hoping I would.

I will definitely continue to keep tracking my my savings and I recommend you tracking your progress as well.

You will be able to see how far you have come and how much there is left to go, regardless of whether you are paying off debt or building your savings. There is so much power in seeing how far you have come and watching the amount you still need dwindle.

How do you track your money progress?

TIP: Do you like the idea of earning cash back when you shop for groceries, eat at restaurants or shop online? With Ibotta, you can do just that! Ibotta is an online app that gives you cash rewards when you shop online or scan your grocery receipts. It’s a simple way to earn extra cash! Get a $10 bonus when you sign up with Ibotta!

Like this post? Check out all the rest in:

Hi! I’m Charissa. I’m on a mission to help hardworking women overcome money struggles and gain financial peace with a Biblical perspective so they can have the freedom to impact their families and communities. Ready to make some changes that will impact your finances in 2020? Click here to get a free worksheet to help you make it happen!

Thanks for putting the pin to this post into The Pinterest Game. Also thanks for being an awesome co-host to the Game.