Save time and money with my best-selling resources in Complete Change Your Finances Bundle.

Why tracking your savings will change your life

Does it seem like your savings account is just a revolving door? You put money in and you take money out?

I know the feeling. It’s hard to see any progress when you are saving for something, like school tuition, when it gets paid every couple of months, but your account keeps dipping.

Last year, I tried an experiment of tracking every. single. dollar that I saved. I counted any tangible money that I could put into savings and wasn’t going to use, after paying for all my regular expenses for the month.

Let me tell you, tracking your savings is so awesome! Over the last year, I managed to put into savings $19,248.60, but even more impressive was the change of my attitude. Instead of feeling hopeless and discouraged that I wasn’t making any forward progress, I became excited to watch my savings grow.

I started attacking my regular expenses and looked for ways to bring in extra money. I couldn’t wait to see the savings increase each month. I was pumped! And you know what? I am going to continue using my Savings Tracker this year as I make the final push towards the last bit of tuition payments, which is my primary money goal of the year.

Never have I been one to hold back on sharing something helpful that you can also benefit from, so I cleaned up my Savings Tracker and have made it available to you for free.

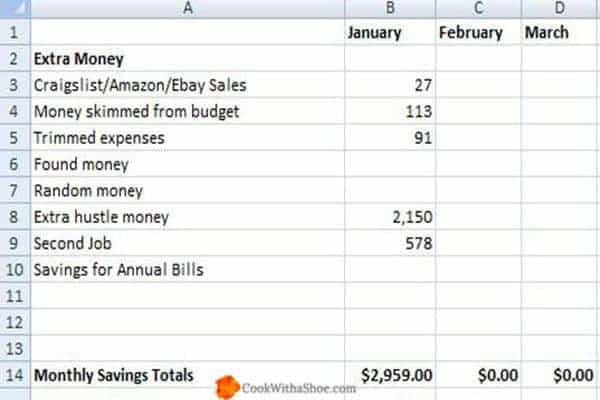

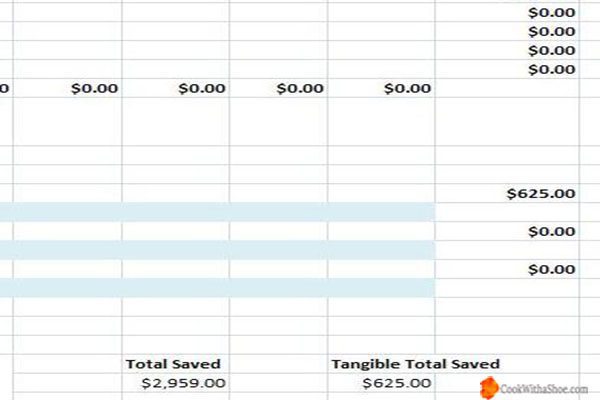

Here’s a snapshot of my savings tracker from last year. All the details can be found on my monthly savings reports.

I’ll walk you through filling out a blank savings tracker so you can know how you can use it.

Column A explains where the extra money came from and can be customized for what works for you. Just double click on the field, erase the word and type in what you want.

The source of extra money may vary from month to month, but I wanted to see how much I had earned from trimming regular expenses or selling items online.

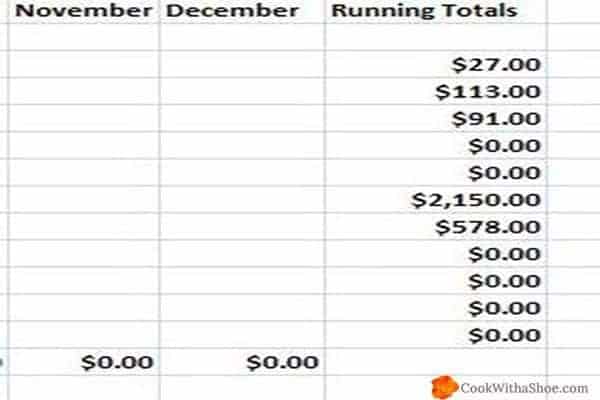

Each row of extra income will tally from left to right and the running total is shown on the last column on the right.

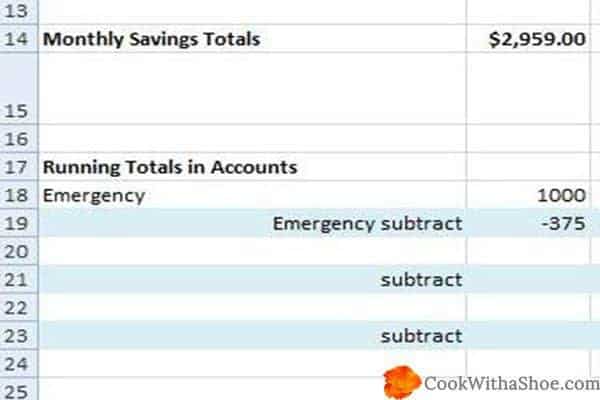

The bottom portion of the spreadsheet tracks how much you can save towards each specific goal. Again, these can be customized for your savings goals. Just double click on the field, erase the word and type in what you want.

I wanted to make a way to track how much was added towards my emergency fund or school, and also have the spreadsheet calculate how much was deducted if I made a payment. The blue lines are your subtract lines.

For example, if I was able to put in $1000 to my emergency fund one month, but then then next month I had to withdraw $350, I can still have an accurate total of what is in my account.

In this example, I enter $1,000 on January on the top line (the white one), in my emergency fund, because that is how much I saved. Then in February (oops, I put both transactions on January, but they will work the same), I wasn’t able to put any money towards the emergency fund, but had to withdraw $350 instead. I enter in the $350 on the blue line that says Emergency Subtract.

Instantly, the running total, at the far right, calculates appropriately.

Now the really cool part! The monthly totals found on row 14 will instantly be calculated into the Total Saved, which can be found at the bottom right of the spread sheet. If your savings are like mine, and they ebb and flow, seeing the Total Saved number increase each month, helps you know that you have done a good job of putting money aside.

The second thing which is helpful, is the Saving Goal Running Total, also at the right side of the spreadsheet. This will calculate based on any additions and subtractions, so you can see at a glance how much you have in each account.

There are notes which are found at the left bottom corner of the spreadsheet, explaining the different ways your savings is tracked, and can be deleted once you no longer need them.

If you do have any questions about how to use the Savings Tracker or if I left out something, just leave them in the comments and I will address them.

Tracking your Savings will show you that you are making progress, even when it doesn’t feel like it, and will motivate you to continue to find more ways to cut expenses or bring in more money so you can see your savings balance grow. I’d love to hear how the Savings Tracker works for you!

TIP: Do you like the idea of earning cash back when you shop for groceries, eat at restaurants or shop online? With Ibotta, you can do just that! Ibotta is an online app that gives you cash rewards when you shop online or scan your grocery receipts. It’s a simple way to earn extra cash! Get a $10 bonus when you sign up with Ibotta!

Like this post? Check out all the rest in:

Hi! I’m Charissa. I’m on a mission to help hardworking women overcome money struggles and gain financial peace with a Biblical perspective so they can have the freedom to impact their families and communities. Ready to make some changes that will impact your finances in 2020? Click here to get a free worksheet to help you make it happen!

good job at saving money

Thank you Gail. The savings tracker helped a lot as it was a great way to see my progress.

I’m thinking of replacing my quicken system and going back old school to spreadsheets. As an accountant, there were some things about Quicken that drove me crazy but I sure do love when my income at the end of the month was favorable. Thanks for sharing with Small Victories Sunday Linkup. Pinned to our linkup board.

Tonya, I do like Quicken for all the reports, but lately I have been going really old school with a notebook and a pencil. It is so nice when you have extra money at the end of the month.

Wow…you are so good! I could definitely take some inspiration from you! Thanks so much for sharing at Share The Wealth Sunday! I hope you’ll join us tonight for a new party! xoxo

Thank you Lisa. Tracking my Savings really helped me with saving even more as I like to see the numbers grow.

Congratulations on your savings! Impressive! I would like to try to use the Savings Tracker, but for the life of me I can’t figure out how/where to download it. Please help – Thank you!

Hi FMCath! Thank you, I was amazed at how much all the small savings added up to over the year.

I’m sorry you have been having trouble getting the Savings Tracker. This freebie is available to all my VIP subscribers, and you can sign up on either the opt in form that slides in on the bottom right corner or in the the opt-in form in the middle of the article (on this page or any other opt in will get you to the same place).

This will lead you to a VIP page where you can access the form, with instructions on how to download your Savings Tracker. I’ll go ahead and email you too.