What makes it harder to pay when you are using cash?

There is a disconnect between your mind and your money when you pay with plastic (either debit or credit), than when you pay with cash, as stated in this article, “How You Spend Affects How Much You Spend: Credit, Scrip and Gift Certificate Purchases Found to be Higher than Cash Buys”, from the American Psychological Association (retrieved from the website 1/13/15). Buyers paying with a credit card tended to pay a higher amount than those who were paying with cash. Well, if I am trying to control my spending and making every dollar behave, then I need to use cash! I can not afford to pay more for the convenience of getting the item now without paying for it until later on a credit card.

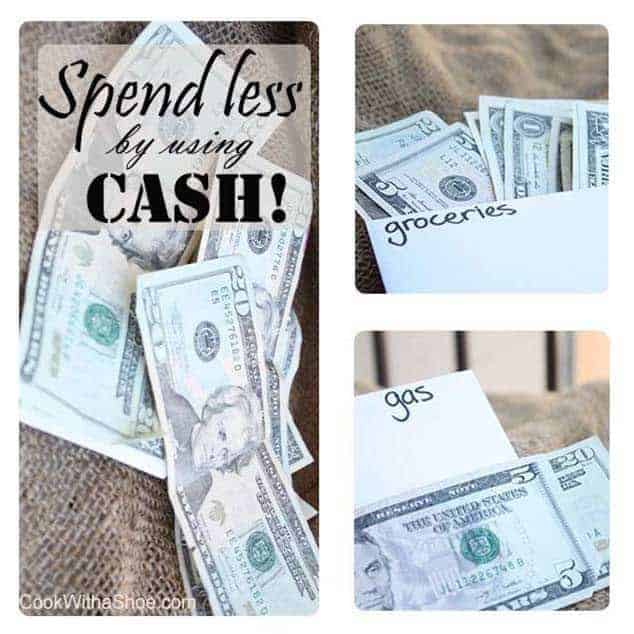

Storing your cash in envelopes

I started using cash when I was working on paying off my debt. That was quite the transition from paying for everything with the debit card to actually thinking about and planning how much cash I would need for the next couple of weeks in order to go to the bank to get my funds. Using envelopes to store my cash was extremely helpful so that I could keep all my spending categories separate, without having all the money jumbled up together in my wallet. This is called the Envelope System, and I am a huge fan! The Envelope System allowed me to see how much money I had in that specific category at a glance. I became a lot more careful with how I spent the money because it was limited to what I had in the envelope. Another reason that changed how I spent money was the fact that it is downright painful to hand over cash. I look at each of those bills in my hand, knowing exactly how many hours of work it took to pay for that purchase, and I make the decision if I really do want to spend the money on that item(s). There are many times I decide that I can make do without buying ____ and I put it back. There needed to be a plan set up before going into the store, on exactly what I wanted to purchase with an idea of how much each thing would cost. Using a plan had the additional benefit of cutting down on my extraneous purchases made on a whim. There was no cash for that extra thing once I bought what I planned to buy.Buyer’s guilt became a thing of the past

My husband and I would decide how much money would be assigned to each specific category before the month began. When I wanted to purchase a specialty item at the grocery store or a piece of clothing, I could go ahead and buy it. For example. if there are 30 dollars in the clothing envelope and I feel like getting some new clothes, I can as long as I stay under the $30 mark. I do not have to feel guilty and I do not have to explain the purchase to my hubby since we had already agreed on the amount of clothing money. Of course, if you buy too many specialty items causing you to not have enough money for milk and eggs for breakfast the last week of the month, there is a problem! However, using envelopes with a set amount of cash does allow you the freedom to purchase what you need, and want (within reason).

Changing your mindset

The key here is discipline. You need to change your mindset to only making purchases that you can afford right now with cash while planning for the month as to what you will need later on and making sure that you leave enough money to cover those later expenses. Prioritizing your needs above your wants and possibly foregoing buying what you want (at least this month, when you do not have the money for it), needs to become an active process in your purchasing habits. Doing so will cut back on a lot of wasted money and give you more money to use for a better purpose. Remember, you have a plan for your money now and you need to take the responsibility to carry out that plan. Controlling your spending mindset will allow you to be able to reach your financial goals, whether that is to pay off all your debt or to build your savings.What if I can not get to the bank?

Admittedly, there are times that I have not made it to the bank to withdraw my funds for the two week period and I end up using my debit card for a couple of days. I quickly make the purchase without thinking about what I am spending when I use my card compared when I spend cash. I try really hard to remember how much is in my account for that specific category and how much I have already spent in that category this month. However, my memory is definitely not that good! I might be able to keep accurate records with only buying fuel for my vehicle, since I know how often I purchase gas and how much it costs. But trying to keep the tally of what I have spent for groceries, clothes, gifts etc. is too much for me. Invariably, I forget and quickly end up overspending in that category. Not to mention, that I have no idea what my husband has spent! As soon as I can, I plan out how much I will need less what I have already spent in those categories, and head to the bank. It is much easier to control my spending when I am using cash. Money left over, now what? If I don’t spend all the money in a category one month, I will either take the money and deduct it from that envelope to apply it where it is needed elsewhere (savings?) or I will save the money for the following month. For example, I do not have time to shop for clothes this month, but I will use the money next month. In this situation, I will just roll the money over to the following month.Worries about using cash

I have never had a problem with anyone stealing my cash or my purse and I do not worry about it. If you do worry, decide how much you need for all the envelopes you carry for the week and just take out the money weekly. This will ensure that you do not carry so much cash at any one time. Besides, thieves do not know what you carry in your purse/wallet just from looking at you. If you did get your purse stolen, yes, I agree, it would hurt to lose the cash, but it would hurt far worse to have to cancel your credit cards, replace your driver’s license and monitor your credit report for identity theft. You do need to take all the right precautions about keeping your personal property and information secure, no matter what kind of payment that you carry. money envelopes wallets (affiliate link) you can buy at Amazon or on Dave Ramsey’s site.

money envelopes wallets (affiliate link) you can buy at Amazon or on Dave Ramsey’s site.Do you have objections to using cash?

Save time and money with my best-selling resources in Complete Change Your Finances Bundle.

TIP: Do you like the idea of earning cash back when you shop for groceries, eat at restaurants or shop online? With Ibotta, you can do just that! Ibotta is an online app that gives you cash rewards when you shop online or scan your grocery receipts. It’s a simple way to earn extra cash! Get a $10 bonus when you sign up with Ibotta!

Like this post? Check out all the rest in:

Hi! I’m Charissa. I’m on a mission to help hardworking women overcome money struggles and gain financial peace with a Biblical perspective so they can have the freedom to impact their families and communities. Ready to make some changes that will impact your finances in 2020? Click here to get a free worksheet to help you make it happen!