Save time and money with my best-selling resources in Complete Change Your Finances Bundle.

$5,637 gone in just a click.

It always takes my breath away when an amount that large is deducted from my account in a blink. School is about ready to start again and there is one less semester needing to be paid.

22 Tips to Pay Cash for College and Avoid Student Loans

My second job came just in time as God used the new work as the means to provide the money for another semester, for which I am extremely grateful. Additionally, my husband filled out a FAFSA form at the beginning of the year and received a grant of $1,175 for this semester. Yay!

Just a couple of weeks ago, there was only $1,400 saved up for school as you might remember. However, we had enough in other savings to cover the entire tuition and decided to use the savings to pay for school by the deadline.

The paychecks which will be trickling in throughout the next couple of weeks will be used to replenish the empty savings. I only drain savings if there is enough money scheduled to come in very soon, so I do not have to pay for the additional amount of getting on the payment plan or spend a couple of months paying myself back.

By my calculations, we will be on track to start saving again for the spring semester by the 10th of September, which is much sooner than normal. Usually, every summer I have to dip into savings which takes a couple months to recoup the savings before we are able to save for the next semester.

Talking about saving for another semester, I printed an outline picture which we have started coloring in when there is money to put aside for school. The picture is framed and sits near my desk where I look at it multiple times a day.

Get your Money Tracker Color Pages here

Progress can be seen and I can see how much is left before we reach the end of the ever growing goal of paying cash for college. Even after just two weeks of using this picture to track our saving, it has helped bring motivation to save even more and a sense of approaching finality to this school journey.

WHY DO I WORK SO HARD TO PAY CASH FOR MY HUSBAND'S TUITION?

I DON'T LIKE DEBT.

So many of my friends have struggled for years paying back all their student loans. After watching their struggles, I have come to the conclusion that I would rather bust it now by working really hard to give my husband the gift of graduating with the full use of his income.

Yes, I am not going to lie, not having student loans at all upon graduation will be a huge relief to myself as well, especially, since we are going to be done with school a lot later in life than most people.

The debt we brought into our marriage completely stressed me out by having those payments every month. There is plenty of stress with life, but if I can reduce some of the stresses by making better money choices, I will.

Money can still be tight at times, but there has been a sense of freedom in my heart since we paid off our last debt more than five years ago. I do not owe anyone anything. The longer I am on the other side of debt, the desire for anything which cause me to go back into debt weakens. If there is no money, I can do without.

There is also a little sense of pride in paying cash for college. Pride in working hard and accomplishing something huge, when the common message says it is impossible to get through school without any debt.

And yes, you too, can pay cash for school.

Whether you are paying for your own education or paying for your children's college, paying cash and not taking out student loans needs to be a priority in your life. Graduating debt free needs to be your Why; your goal to work towards every day.

You can start saving today for next semester, even if you have already been taking out loans for school, by working backwards.

How much is next semester going to cost?

Divide that by four months (September through December) and you have a reasonable amount of money which needs to be saved each month.

So how do we pay cash for college?

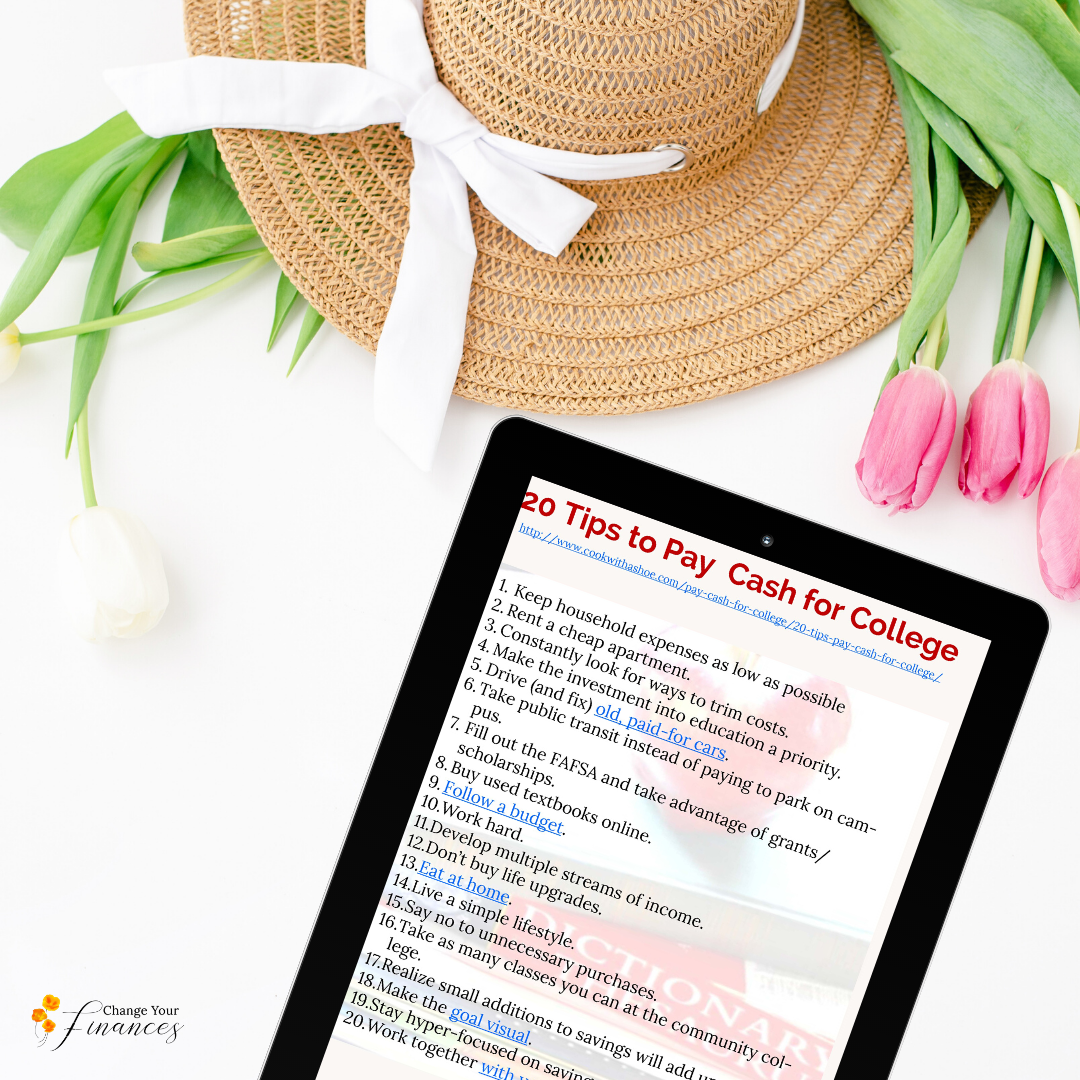

Here are 20 tips how to pay cash for school that you need to know

1. Keep expenses as low as possible

2. Rent a cheap apartment

3. Constantly look for ways to trim costs

4. Make the investment into education a priority

5. Driving and fixing old cars

6. Take public transit instead of paying to park on campus

7. Fill out the FAFSA and taking advantage of grants/scholarships

8. Buy used textbooks

9. Follow a budget

10. Work hard and work a lot

11. Develop multiple streams of income

12. Don't buy into life upgrades

13. Eat at home

14. Live a simple lifestyle

15. Say no to unnecessary purchases

16. Take equivalent classes at the community college

17. Realize small additions to savings will add up over time

18. Make the goal visual

19. Stay hyper focused on saving

20. Work together with your spouse

You CAN pay cash for college and avoid the student loans.

Now, it's your turn. Tell me below what you've done to pay cash for college?

Hi! I’m Charissa. I’m on a mission to help hardworking women overcome money struggles and gain financial peace with a Biblical perspective so they can have the freedom to impact their families and communities. Ready to make some changes that will impact your finances in 2020? Click here to get a free worksheet to help you make it happen!

This is so good! I am glad that we’re paying cash for my Master’s and wish I had done so for my Bachelor’s. Hopefully your advice will help others avoid a pit of debt for school.

Yay Andrea, paying for your Master’s degree with cash is super impressive! Many of these tips can be used to pay for another big goal or even pay off debt too. When people say school loans is a good debt, I have to wonder, especially when I see so many people struggle for years to pay all their school loans back.

Hi Charissa

I have another idea for paying cash for college. This is especially helpful if you are able to start ahead of time, but any effort for the present pays dividends for the future.

1. Open up a 529 college savings plan (or see if your namesake relative would open one in your name). This is essentially an investment plan which can be drawn upon tax free for college/trade school use. The purchaser controls the account until it is used for the beneficiary’s education (that could be yourself!) and the funds can be invested in a variety of instruments. The longer you have it open before you need it, and the more you can put it, the larger return you can get on it, thus making your cash payment for tuition have more leverage.

Although there is no benefit on the contribution from the federal taxes, Arizona allows a nice tax credit of up to $2000 for a single or $4000 for married couple. Each state has their own rules and benefits, and you are not restricted to use the state where you live or go to school.

The benefits in dollars may look like this:

*A couple puts away $4000 at one time on Jan 1 in a 529 fund which gains 10% interest for the full year before they need it. (Let’s assume it is simple interest for easy numbers. Compound interest gives larger real numbers, so that can be a pleasant surprise in the end.) Interest = $400

*If the amount of AZ tax owed is $4000 before accounting for the 529, you now have a $4000 credit to pay it off (and you still get to keep the money!) Savings = $4000

*You take out all the money on Jan 1 for tuition. The $400 in interest is tax free for the year of withdrawal, so you have just saved another $60-$100 or more off taxes for the following year.

*With the $4000 you saved on taxes, you could (theoretically) put back in the 529 for the next year.

Summary:

*Money you contributed to tuition from your original resources: $4000 to the 529 plan

*investment interest: $400

*Amount paid for tuition $4400

*Net: $400 plus peace of mind that the funds will be available when you need them

**Savings on taxes: $4060 (or more)–This is money not given to the state government, but you decided where and how and when you were to spend it (invested in your education!)

If you didn’t have a 529 plan, the scenario might look like this:

*Money you contributed to tuition from your original resources: $4000 out of savings (or go on the payment plan and pay interest in addition)

*Interest on the $4000 in savings in the bank= .1% = $4.00 (if you are lucky)

Amount paid for tuition: $4400–all from savings so net payout from your original resources is -$4396 after the interest is accounted

Total payout: -$4400 from savings

Savings on taxes: $0, but you owe $4000, so another $4000 has to come out of savings. The good news is that your $4.00 interest is too small to have to report on your taxes.

Total payout from your savings: $8396 of money you had to provide

529 fund resources:

http://www.irs.gov/uac/529-Plans:-Questions-and-Answers

http://www.az529.gov/AZ529Website_2010/Planning_And_Tools_ArizonaTaxIncentive.html

Thank you for that detailed description of how a 529 Education savings plan works, Holly, super helpful. I did not know about the tax credit you would get for contributions to the plan and that you are able to actually keep the money to pay for school. The earlier you can start saving for your child’s school (or your own if you are paying your own way) the better it will be in the end. That way you have the money ahead of time to pay for tuition, instead of trying to come up with the cash on a limited time, like what I am doing.

Make sure to check your own state’s rules about a 529 plan, if you live in another state.

I paid my college tuition entirely with my savings.

I started working (more than) full-time at the age of 19 to save money. I lived with my mom, but I also helped with a couple expenses. At that time, we used the phone for Internet, so paid for it, plus electricity and helped a bit with general stuff.

I could not get new clothes each week like my colleagues, but I was building my future and it meant a lot to me.

Incredible tips, Charissa!

Totally awesome that you paid your own way through school Debbie! In addition to not getting new clothes, you probably gave up on spending some time with your friends as well, but see what having a goal and working towards it can do for you? You ended up finishing school with zero debt!! I’m impressed.

Great tips, I’m hopping over from anything goes. Hugs!

Hi Katherine! Thank’s for stopping by. I’ll see you around at Anything Goes.

How great to not have to worry about the debt on the other side! That takes a lot of dedication and hard work. I despise owing people money as well. Luckily my husband and I are student debt free. There are enough bills in life, I am glad we don’t have student loans as well!

Hi Carlee, how great it is that you and your husband don’t owe any student loan debts! You are so right, there are enough bills in life and it’s nice to not add student loan debt. Yes, a lot of dedication and hard work, but I know it will be worth it on the other side. Thanks for stopping by!

This is good advice. Both of my daughters have substantial student loan debt. It is a matter of pay now or pay later. They did live frugally, but it was never enough.

Thank you Michelle. I am sorry to hear about your daughters’ student loan debts. School costs have risen a lot and can be daunting to try and pay for in the middle of school. It is a hard sacrifice to bust it and pay now, but it can be done.

You have done so well, we are all cheering you on and learning at the same time. Thanks for bringing such quality posts to Fridays Blog Booster Party #20

Kathleen

Thank you for all the encouragement, Kathleeen, I appreciate it so much. I love Friday Blog Booster Party and am thankful to be a part of such a great community.

These are fabulous ideas and it’s perfectly possible to do college/private school/higher education without debt. My husband and I did it and it’s so worth it. Thank you for sharing your post at the #AnythingGoes Link Party.

Yes, Sandy, it is possible to pay for education without debt and becomes a matter of priority and belief you can do it. I would love to hear your story someday, on how you and your husband received your education without any debt. Maybe an interview on Cook With a Shoe? 😉